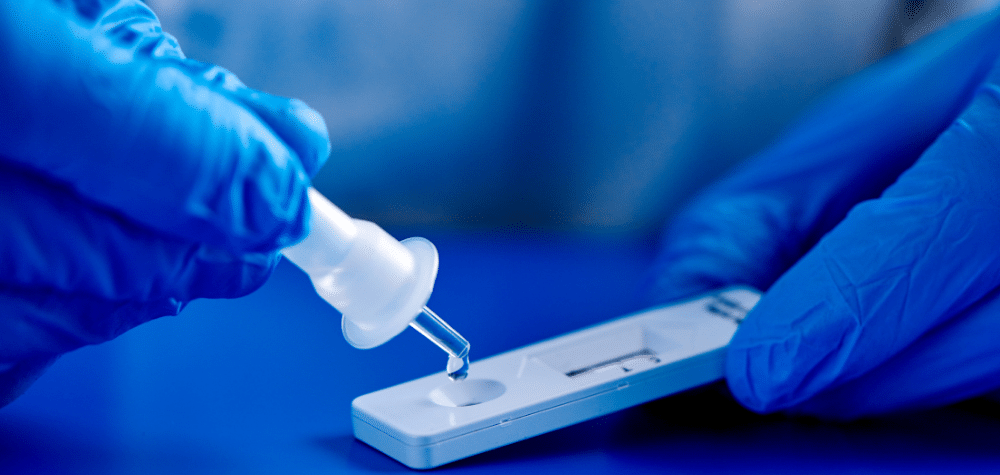

Early this month, the Federal government announced that it intends to pass legislation to allow for Rapid Antigen Tests (RATs) used for Covid-19 testing to become a tax deduction if used to test before attending a place of work.

They will also be exempt from fringe benefits tax (FBT) for businesses that purchase them for work-related purposes.

If the legislation becomes law, it means that for every COVID-19 test you pay for to do your job or run your business, you will be able to claim (if you keep your records).

For example, a person on more than $45,000 would receive around $6.50 back on $20 spent.

This legislation will backdate to cover the 2021-22 FBT and income years.

Essentially, if you purchase the test after July 1, it will be eligible. However, not any bought before that day, even if you took the test in July.

In the interim, if you have incurred expenses for COVID-19 tests, you should keep a record of those expenses. Much like you would for any tax-deductible expense, receipts for the purchase of RATs need to be saved.

However, understand that you can only claim tests if you purchased them for work-related purposes. If you bought them for personal use, you could not claim them on your tax return.

Tax Deduction for RATs – Travel Costs

On a side note, if you need to have a COVID-19 test due to the requirement by the destination jurisdiction for you to enter the overseas country or state, it may be deductible also. These costs would fall into incidental expenses for a work-related trip. The deductions also extend to tests required to return to Australia or your home state. However, if your travel is for work and private purposes, you may need to apportion your expenses.

Stay tuned for the exact details once the legislation becomes law.

If you require help with your business’s FBT liability, your tax or have a query, we are registered tax agents able to assist you in your endeavours. Please speak with us.