As an entrepreneur, it’s essential to recognise the risks that can affect your business. Risks come in two broad categories: internal and external. Internal risks are related to the operations of a business, such as human resources, budgeting, technology or market strategy. On the other hand, external risks are related to the environment outside of a business’s control, such as competition, changing consumer trends or economic conditions.

In this guide, we’ll cover the different types of internal and external risks that businesses face and provide you with some tips on how to identify and mitigate them. By taking the necessary steps to identify potential risks and devise strategies for dealing with them, your business will be more prepared to handle unexpected challenges.

Types of internal risks

Internal risks are the ones that originate within the business and can be managed through sound decision-making, operational processes and compliance. Some common business risks include:

• Human resources: High turnover rates or inadequate training can lead to employee dissatisfaction or inefficient operations.

• Budgeting: Poor budgeting practices can result in a lack of resources or funds.

• Technology: Not keeping up with the latest technology can lead to outdated systems and processes.

• Market strategy: Poorly chosen strategies can result in missed opportunities, lost customers or lower sales.

Employee training

Staff training is an essential internal risk for any business. Poorly trained employees can lead to decreased productivity and a lack of understanding of company policies, procedures and goals. A lack of proper staff training can also make it difficult for businesses to keep up with changes in their industry or stay competitive in the market. To mitigate this risk, businesses should provide employees with regular and comprehensive training to ensure they have the necessary skills and knowledge to do their job effectively. Additionally, businesses must stay up-to-date on the latest trends in their industry and update employee training materials accordingly. By investing in employee training, businesses can be better prepared to face internal risks.

Financial risk

Financial risk is another internal business risk that businesses must be aware of. Credit risk, in particular, is a common financial risk that businesses face. This type of risk refers to the possibility of a business being unable to pay back its loans or other debts. To mitigate these financial risks, businesses should carefully evaluate their creditworthiness and develop strategies for managing cash flow. Additionally, businesses must avoid taking on too much debt or taking out loans with high-interest rates. By understanding their credit risk and taking the necessary steps to manage it, businesses can reduce their financial risks and keep operations running smoothly.

Cyber Security

In the digital age, cyber security is a top priority for businesses. The loss of customer data, confidential information or trade secrets can hurt the reputation of a business and could even lead to legal action. To protect against these risks, businesses need to implement effective cyber security measures such as password protection and encryption software. The management team should also keep up to date with the latest cyber security trends and ensure that their systems are regularly updated. Additionally, businesses must train their employees on the importance of cyber security and provide them with the necessary tools to protect confidential data. Businesses can mitigate risks and ensure customer trust in their operations by taking these steps.

Types of external risks

External risks come from outside the business and are more challenging to manage. Some common external risks include:

• Competition: Changing competitive conditions can lead to decreased market share or lost customers.

• Consumer trends: Shifts in consumer preferences or buying habits can affect sales and profits.

• Economic conditions: Changes in the economy, such as inflation or recession, can reduce demand for products and services.

• Natural disasters: Emergencies such as floods, earthquakes or other natural disasters can cause significant disruption.

• Political and legal risks: Government regulations or political changes can unexpectedly impact a business.

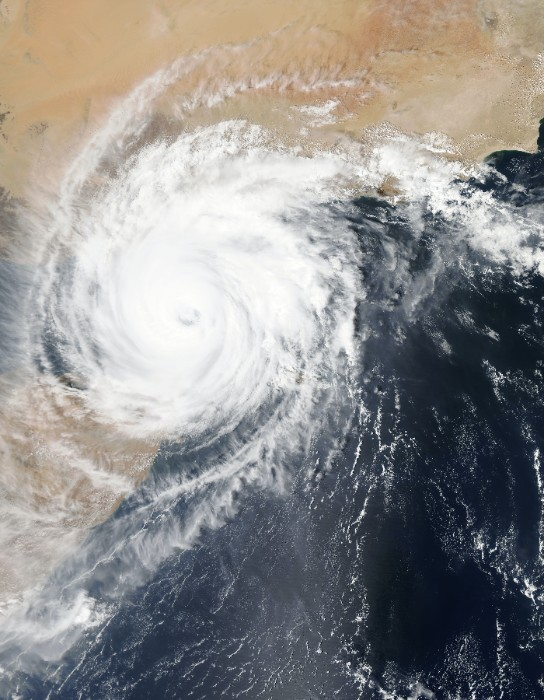

Natural Disaster

Natural disasters are an external risk that can have a devastating impact on businesses. From floods to earthquakes, natural disasters can cause significant physical damage and disrupt operations and supply chains. Businesses need to take steps to prepare for natural disasters, such as creating emergency plans and regularly backing up data. Additionally, businesses should be aware of the potential risks of operating in areas prone to natural disasters and assess their ability to respond. By taking the necessary steps to prepare for natural disasters, businesses can be better equipped to face these external risks.

Supply Chain

Supply chain risk is another external risk that businesses must consider. This type of risk refers to any disruption in the supply chain that can negatively impact the business’s ability to trade. For example, a supplier may be unable to provide goods or services due to an unexpected shortage or a prolonged delivery delay due to poor logistics. This can lead to delays in production, lower sales, and ultimately reduced profits. To mitigate this risk, businesses should have good relationships with suppliers, establish alternative sources of supply and develop strategies for managing disruption in the supply chain. Businesses can ensure that their operations remain on track by taking these steps.

Power Outages

Power outages are one of the external events that can significantly impact businesses. Power outages can lead to disruption in operations, damage to equipment and lost revenue. Power outages could also negatively affect customers by reducing the quality of their experience or preventing them from using a service altogether. To mitigate this risk, businesses can have backup generators or alternative power sources that can be activated during an emergency. Additionally, businesses should consider investing in technology such as battery backups or portable power systems to ensure continuity of operations and provide a better customer experience. By taking these steps, businesses can limit the impact of power outages on their operations and customers.

Tips for Identifying & Mitigating Risks

Identifying potential risks is the first step in managing them effectively. Here are some tips for identifying and mitigating risks:

• Monitor changes in the industry, economy and competitive environment regularly to be aware of potential risks.

• Assess internal operations regularly and make improvements where necessary.

• Establish effective procedures for monitoring and responding to external risks.

• Develop contingency plans for dealing with potential risks.

• Make sure you regularly review and update your risk management strategy to account for environmental changes.

SWOT analysis

SWOT analysis is a valuable tool for businesses to use as part of their risk assessment. SWOT stands for Strengths, Weaknesses, Opportunities and Threats and is used to identify significant risks that could affect the business’s success. By assessing each of these four categories in detail, businesses can identify potential risks and take steps to mitigate them. Strengths and weaknesses refer to the internal capabilities of the business, while opportunities and threats refer to external factors such as market changes, competition or economic conditions. By taking these into account, businesses can better understand their vulnerabilities and plan accordingly to address any risks that may arise.

The Importance of Risk Management in Business

Risk management is an essential part of any successful business. By taking the time to identify potential risks and develop strategies to mitigate them, businesses can be better prepared to handle unexpected challenges. Identifying and addressing risks early can help reduce the impact on a business in the long run. Investing in risk management is an important part of protecting your business’s future.

Risk Management Plan

Creating a Risk Management Plan is an important step for any business. A Risk Management Plan outlines the business’s approach to identifying and managing risks and strategies for responding to them. Risk Management Plans help businesses identify potential risks, such as financial or operational issues, and develop action plans to address them. Risk management plans can also help organisations anticipate risks and proactively take steps to reduce the chance of a risk occurring.

The Risk Management Plan must include an assessment of the potential risks across all areas of the business and procedures for responding to them. The plan should identify key individuals known as risk managers who are responsible for monitoring and managing risks, assessing each risk’s financial impact, and providing guidance on how to handle each risk. Risk Management Plans need to be regularly reviewed y the risk managers and updated to keep up with changes in the business environment.

By creating a Risk Management Plan, businesses can ensure that they have a comprehensive strategy for addressing any risks and can anticipate potential issues before they arise.

Business Continuity Plan

A Business Continuity Plan (BCP) is essential to managing risk and ensuring that business objectives are met. A BCP outlines an organisation’s steps to quickly recover from disruptions, such as natural disasters or power outages. It helps organisations prepare for potential risks and plan how to respond in case of a disruption.

The BCP should include Risk Assessments to identify potential risks, strategies for mitigating those risks, and an Emergency Response Plan that outlines the procedures for responding to a disruption. The plan also needs to include a Testing & Review Process to ensure that the systems in place are effective and up-to-date. Additionally, the BCP should consist of business continuity and recovery strategies, such as data backups and redundancy plans.

By having a comprehensive BCP in place, organisations can ensure that they are prepared for any potential disruptions. The Risk Assessments included in the plan help identify potential risks, and the strategies developed to mitigate them can help minimise their impact on business operations. Furthermore, the Emergency Response Plan helps organisations quickly recover from disruption and return to business operations. A BCP is essential for any organisation looking to manage risk and meet its business objectives.

Insurance Policies

Insurance policies are a vital part of managing risk. They help protect businesses against potential losses from identified risks that could be reduced to low risk with the right protection. Insurances policies provide businesses and organisations with financial security in the event of an unexpected loss or damage caused by specific circumstances, such as natural disasters or accidents.

Insurance policies can cover business property, vehicles and equipment, and employees. For example, workers’ compensation insurance helps cover medical costs and lost wages for employees in an accident or injury. Businesses may also choose to take out additional insurance policies to protect against property damage or liability claims from clients.

Having the right insurance policies in place can help organisations manage their risks and provide peace of mind that they are protected against potentially costly losses. It is important to carefully consider the types of insurance policies a business should have and the coverage levels that best meet their needs. Risk managers should also regularly review their insurance policies to ensure that they are up-to-date and meet the business’s needs. Risk Management Strategies

Conclusion

Risk management is an essential part of running a successful business. Risk managers must identify and assess risks, both internal and external, to effectively manage them. With Risk Management Strategies in place and the right insurance policies covering potential losses, businesses can ensure they are protected against any potential risks. Additionally, having a Business Continuity Plan helps organisations prepare for potential disruptions and return to operations quickly. Risk management is essential for any business looking to reach its objectives and ensure success.

Let’s Get Started

If you’re looking for help with identifying and managing your business’s risks, look no further! Our team of experts have years of experience in helping businesses identify and mitigate potential risks. Contact us today to get started.

Contact us: neil@neilradfordaccountant.com.au or (07) 3453-1848. Follow us on social media for updates and resources about small business growth.

We look forward to hearing from you!

FAQ

Q: What is Risk Management?

A: Risk management is identifying, assessing and mitigating risks that can affect a business. It involves analysing potential risks and developing strategies to manage them effectively.

Q: Why is Risk Management important?

A: Risk management is essential as it helps businesses prepare for unexpected events and minimise the impact of potential risks on their operations. Risk management can help protect a business’s future and ensure the continuity of operations.

Q: What are some risk management strategies?

A: Risk management strategies include monitoring changes in the industry, economy and competitive environment; assessing internal operations regularly; establishing effective procedures for responding to external risks; and developing contingency plans for dealing with potential risks. Additionally, businesses should review and update their risk management strategy regularly to account for environmental changes.