Have you been hearing a lot about business activity statement(s) and feeling more than a bit of pressure?

Kicking off the new year for your business shouldn’t be shrouded in the darkness that can be a looming BAS. But how can you be sure that your business is ready?

To start with, demystifying the BAS might alleviate some of that anxiety and pressure your business may have been facing. Essentially, a business activity statement (BAS) is a form that all businesses must lodge to the Australian Tax Office (ATO). Importantly, all businesses registered for GST need to lodge a business activity statement (BAS). You can do this with the assistance of a registered tax agent or BAS agent.

A BAS is a summary of taxes you have paid or will pay to the government during a reporting period. You may lodge your BAS monthly, quarterly or annually (depending on the size of your business, you may not have the annual or quarterly option).

What Makes Up A Business Activity Statement

When lodging your BAS, you may need to include these payments within it:

- Goods and services tax (GST)

- Pay as you go (PAYG) income tax instalment

- Pay as you go (PAYG) tax withheld

- Fringe benefits tax (FBT) instalment

- Luxury car tax (LCT)

- Wine equalisation tax (WET)

- Fuel tax credits

The ATO creates a BAS before the end of each month or quarter (depending on your reporting cycle). Lodgement and payment are due as follows:

- For monthly BAS: within 21 days of the end of the month on the form

- For quarterly BAS:

- July – September: Due 28 October

- October – December: Due 28 February

- January – March: Due 28 April

- April – June: Due 28 July

(as registered tax agents, we are given a four-week extension to most of these deadlines – except for the December Quarter)

Instalment Activity Statement

Instead, you may be eligible to submit an Instalment Activity Statement (IAS). In the IAS, the ATO tells you what your GST instalment amount is and, where applicable, your PAYG instalment amount. Essentially, the IAS is a form similar to the BAS but simpler in that you do not have to be concerned about GST and some other nominated taxes.

Businesses that do not require GST registration and individuals required to pay PAYG instalments or PAYG withholding (such as self-funded retirees) use this form to pay PAYG.

Therefore, IAS provides a little more flexibility in the arrangement as the ATO advises the instalments on what you need to pay to cover your liabilities.

You may be able to vary those amounts if you feel that the advised instalments are too much or not enough to cover your liabilities. You may also be able to pay the amount in one lump sum at the end of the year. Before changing the amount due or the timing of the payment, it’s best to consult with us (or your registered BAS agent) for additional advice to suit your circumstances.

Preparing For Your BAS

Your IAS and BAS can be used to assist in monitoring your business finances. Though you only need to lodge these every quarter, waiting until the due date to get all of the information you require for the statements may cause you to miss out on critical observations (such as how much you may owe the ATO).

In addition, Daily tracking of your income and expenses can assist in calculating your GST and other liabilities on your BAS and ensures that there won’t be any nasty surprises waiting for you.

Here are some tips on how you can prepare for your BAS or IAS this quarter

- Get everything up to date (such as your accounting software), and ensure that all of your bank feeds are imported, allocated and reconciled.

- If you are completing the BAS yourself, ensure that you print/save the reports from your accounting software every week – this should give you an estimate of what you would have to pay if your BAS was due right away.

- Check that your bank account for your business has enough money in it to cover your BAS payment.

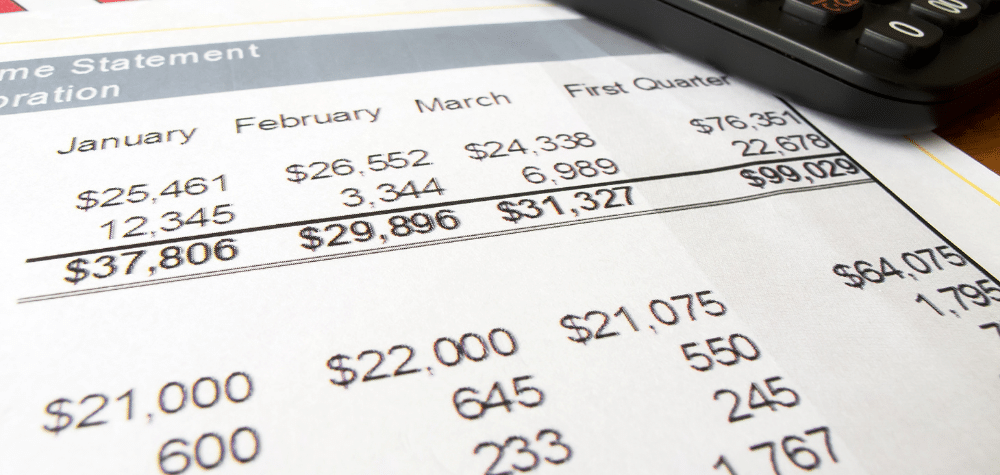

- After printing your BAS reports, create a profit and loss statement showing how much money you have made in the week (or month) to date.

If you need help with preparing and lodging your BAS, please do not hesitate to contact us.